CHAPTER

01

Significance and Risks of FDIs

-

Hamaguchi

-

Today, we shall discuss FDI Regulations and the practice of them, which have recently attracted much attention. Let me start by confirming the significance and risks of FDIs, and thereafter we will discuss the purpose of FDI Regulations.

-

Osawa

-

One of the merits we can expect from FDIs is the introduction of highly advanced foreign management resources (including management know-hows, technologies, and human resources) into Japan. Such introduction would contribute to the improvement of domestic productivity and job creation, thereby leading to the sound development of Japan’s economy.

It is also expected that foreign human resources, technologies, know-hows, and capital would flow into rural areas and become linked to local resources (such as tourism, agriculture, forestry, and fisheries), thereby serving as a trigger for regional revitalization.

-

Hamaguchi

-

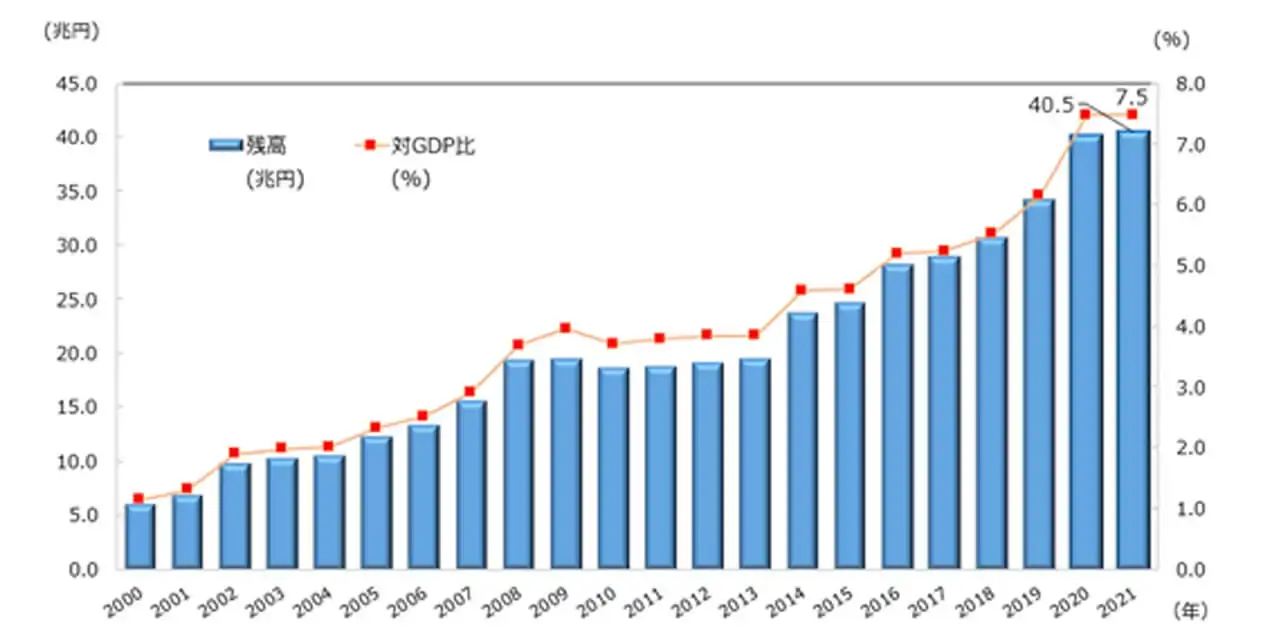

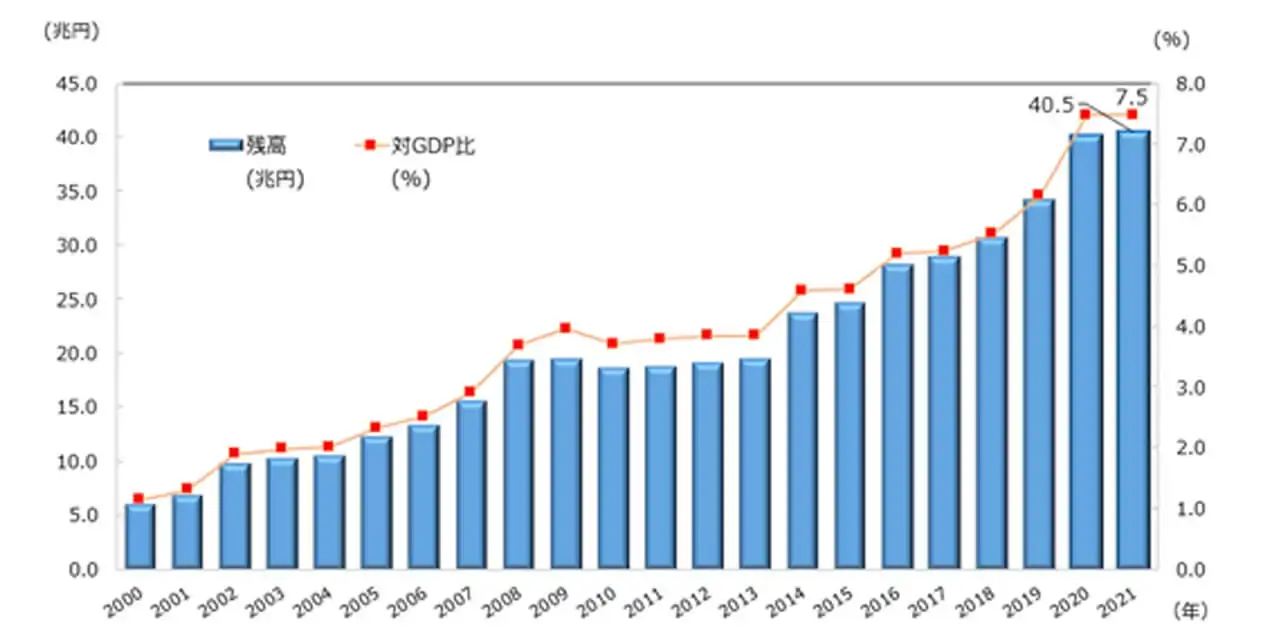

The Japanese Government is promoting FDIs in Japan under the slogan “INVEST JAPAN.” The Government expects such positive results. As the fruit of the Government’s efforts, the FDI stock in Japan has generally been on an uptrend, reaching a record high of 40.5 trillion yen at the end of 2021.

Trend of Recent FDI stock in Japan

(Source:https://www.jetro.go.jp/invest/investment_environment/ijre/report2022/ch1/sec2.html)

-

Osawa

-

The “Strategy for Promoting Foreign Direct Investment in Japan” decided in June 2021 stipulated a new target of doubling the FDI stock in Japan to 80 trillion yen by 2030. The governmental promotion of FDIs in Japan is expected to continue.

-

Roku

-

Having said that, from the viewpoint of foreign investors, FDI Regulations in Japan seem to have become increasingly strict recently. What are the concerns of the Japanese Government in relation to the risks of FDIs?

-

Osawa

-

For instance, in the international community, “economic statecraft,” the use of an economic means to pursue foreign policy goals, has been gaining momentum recently. Under such circumstances, it is concerned that FDIs, as an economic means, may be used for economic statecraft, thereby undermining the national security of Japan.

The Japanese Government addresses the risk that national security may be impaired by FDIs in an appropriate manner, through prior FDI screening under FEFTA. Specifically, when a foreign investor makes a certain investment, etc., in a Japanese company and the company carries on one of the business sectors designated as those related to national security, etc. (the “Designated Business Sectors”), as a general rule, the foreign investor is required to file a prior notification.

The Japanese Government has the authority to scrutinize each FDI (for which a notification has been filed) from the perspective of national security, and if necessary, it may take measures such as ordering the investor to discontinue the FDI.

-

Hamaguchi

-

What sort of FDIs are considered as possibly undermining national security?

-

Osawa

-

A typical example is an FDI by which a foreign investor intends to gain influence over a Japanese company and acquire its sensitive technologies or information against the background of this influence. Once sensitive information (e.g., (i) advanced technologies that can be diverted to military use and (ii) technical drawings of Japan Self-Defense Forces’ defense equipment) is leaked through such an FDI, this information may be leaked to countries of concern or be used to manufacture weapons of mass destruction, etc. This may pose a direct threat to the national security of Japan.

-

Roku

-

I do not think it is necessarily the case that every foreign investor aims to pursue strategic national objectives by investing in Japanese companies. Is the Japanese Government focusing on investments made by so-called foreign government-affiliated investors?

-

Osawa

-

No, even if a foreign investor does not intend to pursue its foreign national interests, the investor’s FDI may negatively affect the national security of Japan, depending on the planned management involvement policy, etc., of the investor. The Government pays special attention to such FDIs as well.

Imagine a Japanese company whose businesses include manufacturing defense equipment for the Japan Self-Defense Force, and a foreign investor plans to acquire this company and abolish the defense equipment manufacturing business due to its low profitability or other commercial reasons.

If the defense equipment is highly important and it is difficult for other companies to manufacture it in place of this company, the acquisition could result in a decline of Japan’s defense capabilities. Although this kind of FDI is not an investment in pursuit of foreign national interests, it could also undermine national security.

-

Hamaguchi

-

FDIs not only pose a positive significance, but also carry risks.

-

Osawa

-

Yes. Given the significance and risks of FDIs, FDI Regulations aim to promote sound FDIs that contribute to the development of Japan’s economy, while addressing, in an appropriate manner, investments that are problematic from the viewpoint of national security.

CHAPTER

02

Recent Revisions

-

Hamaguchi

-

There has been a series of revisions related to FDI Regulations since 2017.

-

Osawa

-

There were two major revisions to FEFTA. One was enforced in October 2017 (promulgated in May 2017) and the other was enforced in May 2020 (promulgated in September 2019). In the October 2017 revision, certain transactions by which a foreign investor acquires unlisted shares from another foreign investor (called “specified acquisition”) became subject to prior screening. Besides, the Government was granted the authority to issue an “order for measures” (typically, an order for sale of shares) against a foreign investor who had conducted certain investments, etc., without filing a prior notification or with a false notification.

-

Hamaguchi

-

It appears that the revision that had a greater practical impact was the May 2020 revision.

-

Osawa

-

In the May 2020 revision, the scope of FDIs subject to prior screening was amended so that the Government would be able to review FDIs that may interfere with national security. For instance, the threshold for the prior notification duty was lowered from 10% to 1% regarding listed share acquisitions. Besides, the revision introduced the prior notification regime for particular activities of foreign investors (other than investments), such as voting in a shareholders’ meeting for the (i) appointment of directors or corporate auditors and (ii) transfer or abolition of certain businesses.

On the other hand, the May 2020 revision introduced special provisions for the exemption of the prior notification duty in particular cases, to further promote FDIs that contribute to the sound development of Japan’s economy while appropriately dealing with FDIs that may harm national security. Relying on these special provisions, a foreign investor is exempted from the prior notification duty on the condition that the investor complies with certain statutory standards when conducting certain types of share acquisitions.

-

Hamaguchi

-

There have been multiple revisions to expand the scope of the Designated Business Sectors.

-

Osawa

-

In the past few years, the Government has expanded the scope to cover (i) the cyber-related business sector (effective from August 1, 2019) in response to the growing importance of ensuring cyber security, (ii) particular pharmaceutical manufacturing, etc., given the necessity to maintain the domestic manufacturing infrastructure of important medical industries related to citizens’ lives and health (effective from July 15, 2020) against the background of the COVID-19 pandemic, and (iii) metal mining, etc., related to critical minerals (effective from November 4, 2021), since ensuring a stable supply of critical minerals is important to economic security.

Major recent revisions to FDI Regulations

|

2017

|

① Introduction of the prior notification regime for specific acquisitions

Acquisitions of unlisted shares by foreign investors from other foreign investors (specific acquisitions) related to particular business sectors have become subject to prior screening.

② Introduction of an order for measures

The Government has been granted the authority to issue an order for measures (such as an order for sale of shares) against foreign investors if such investors had conducted FDIs without mandatory prior notification or with a false notification and if the FDIs pose a risk of impairing national security.

|

|

2019

|

The cyber-related business sector was added to the Designated Business Sectors.

FDIs in the cyber-related business sector have become regulated from the viewpoint of appropriately preventing situations that may seriously affect national security.

|

|

2020

|

To further promote FDIs that contribute to the sound development of Japan’s economy, while appropriately dealing with investments that may jeopardize national security,special provisions for the exemption of the prior notification dutywere stipulated in particular cases.Besides, the scope of FDIs subject to the mandatory prior notification was amended.

- ① The scope of FDIs for the mandatory prior notification

Lowering the threshold for the prior notification duty from 10% to 1% regarding listed share acquisitions. The prior notification regime for certain activities of foreign investors (other than investments), such as voting in a shareholders’ meeting for the (i) appointment of directors or corporate auditors and (ii) transfer or abolition of certain businesses, was introduced.

- ② Introduction of the system of exemption from prior notification

|

|

|

Medical manufacturing industries, etc., were added to the Designated Business Sectors.

Given the COVID-19 pandemic, the manufacturing industry related to medicine for infectious diseases and the manufacturing industry related to specially controlled medical devices were added to the Designated Business Sectors. The aim of this revision was to maintain the domestic manufacturing infrastructure of the important medical industries related to citizens’ lives and health and appropriately prevent situations that could seriously affect the security of Japan and its citizens’ life and health.

|

|

2021

|

Expanding the scope of the Designated Business Sectors to secure a stable supply of critical minerals

To secure a stable supply of critical minerals and overcome the vulnerability of supply chains, etc., certain business sectors related to 34 critical minerals (such as rare-earth elements) and the construction business sectors for maintaining the port facilities of specific remote islands, etc., were added to the Designated Business Sectors.

|

-

Hamaguchi

-

Will there be any revision to the scope of the Designated Business Sectors?

-

Osawa

-

“The Basic Policy on Economic and Fiscal Management and Reform 2022” adopted by the Cabinet in June 2022 expressly stipulated that the Government will review the scope of the Designated Business Sectors related to FDI screening under FEFTA. Therefore, the Government will continue to review the scope in response to changes in the economic security situation, etc.

-

Roku

-

As this point is very confusing to foreign investors, could you explain how to deal with the case where an investee Japanese company’s business was not included within the scope of the Designated Business Sectors at the time of investment but later becomes included in such scope due to a revision thereafter?

-

Osawa

-

Even if an investee’s business sector becomes one of the Designated Business Sectors, a foreign investor is not required to take any immediate measures in relation to its previous investment merely because of this change.

However, when the investor additionally acquires the investee’s shares thereafter or votes for a certain appointment of directors or corporate auditors or business transfer at a shareholders’ meeting, as a general rule, the investor needs to file a prior notification.

The investor is not required to file a prior notification in cases where the investor can avail itself to the special provisions for an exemption of the prior notification or where the investor’s prior notification duty is statutorily exonerated. However, since the relevant statutes are complicated, it would be safer for foreign investors to receive advice from attorneys familiar with FDI Regulations.

-

Roku

-

In this regard, foreign investors should pay attention to the fact that the FDI practice in Japan is not necessarily in alignment with the registration practices at the time of incorporation, etc. For example, in the articles of incorporation of Japanese companies, their business purposes are allowed to be broadly described from the viewpoint of ensuring flexibility of their business activities. Therefore, it is possible to register business purposes that a company does not actually engage in. Even if the company’s business purpose falls within the scope of the Designated Business Sectors, it is possible for the company to proceed with the registration process even when it is not confirmed whether the mandatory notification has been filed or whether the Government has completed its FDI screening. However, an investor who has failed to provide mandatory prior notification would receive a questionnaire from the Government and it may be required to file a notification. It would also be subject to the risk of being punished. Surprisingly, it is my impression that this fact has not been disseminated to foreign investors and Japanese companies which the investors invest in or established.

This roundtable discussion is intended to provide brief general information for your reference only and does not constitute legal advice from the firm. The opinions expressed are the personal views of the authors and do not represent the views of the firm. Due to the nature of the information being general information, the citation of the text and sources of laws and regulations may be intentionally omitted. Please always consult a lawyer on issues relating to individual specific cases.